Frequently Asked Questions

FREQUENTLY ASKED QUESTIONS

- Can Foreigners own condominiums in Thailand?

- Can foreigners own land and houses in Thailand?

- What is “THOR TOR 3”?

- Can I, as a foreigner, get mortgage loan from Thai bank?

- What is a long term lease hold?

- What is limited Thai company?

- Is it safe to set up a company to own land and house in Thailand?

- Can my Thai Spouse own land?

- Are there deeds in Thailand?

- How many forms of deed there are in Thailand?

- Are there property taxes in Thailand?

- Are there taxes or fees apply on property transfers in Thailand?

- What is the procedure of buying properties in Thailand?

QUESTION & ANSWER

1. They have visa to be in Thailand.

2. The total area on the condominium building that can be sold, has not been sold and owned by foreigners more than 49%.

3. The fund they will use to purchase the condominium is sent from overseas or brought in Thailand in foreign currencies and exchange into Baht within Thailand.

Short answer is NO. Foreigners cannot directly own land by their names. Thai law prohibits foreigners from owning land in Thailand. Foreigners have the rights to the ownership of buildings detached or separate to the land. There are also ways foreigners can structure so they can own land and still comply with existing Thai laws. The two most popular ways for foreigners to own land are

1. Take a long term leaseholds and

2. Registered a limited Thai company to own land.

Thor Tor3 is an abbreviation of Thai terms, the Foreign Currency Exchange Transaction form (also known as FET form) in English. Thor Tor 3 is financial institution official document, reporting foreign currency exchange transactions in Thailand. The document proves that the foreign currency remittance into Thailand ON PURPOSE OF PURCHASING CONDOMINIUM/S and exchange into Thai Baht inside Thailand. The FET form is issued by the authorized financial institution inside Thailand that handles the exchange of foreign currency and contains the information such as:

- Transferred amount in foreign currency

- Transferred amount in Thai Baht

- Name of money sender

- Name of money receiver

- Purpose of transferring the money

Foreign Currency Exchange Transaction form must be provided to Land Department when transferring condominium ownerships to foreigners. The fund amount mentioned on FET, converted to Baht, should not be less than the sale price of the condominium. For any foreign currency exchange transactions (buying, selling, depositing, withdrawing foreign currencies) between financial institutions and their non-interbank customers the recipient bank inside Thailand must prepare a FET form for each remittance and exchange of foreign currency with an equivalent of USD 50,000 or more (amount increased in 2010) and report this to the Bank of Thailand.

No, foreigners cannot mortgage properties in Thailand with Thai banks. However, some real estate developers these days provide property loans for their foreign buyers and in most pre-built real estate developments, allow down payment to be made in installments during the constructions.

Land and houses in Thailand can be a lease hold for a period of 30 years maximum, renewable for further 2 times. A lease of longer period than 3 years, the lease has to be registered at The Land Department. A registered long term leases equivalent to freehold owner ships. The lesser cannot take possession of the property upon expiration of the lease. The registered leaseholds are secure and relatively straightforward.

A limited Thai company is the most popular form of business structures in Thailand. Is a company with no more than 49% shares owned by foreigner/s. The rest of the shares must be held by Thai juristic persons who will sign over control of their shares to you, this can be arranged by the lawyer so that you control the company, and which can legally own land. As a managing director of the company, you control the voting of the other shares, and therefore you have control over the ownership of the land.

Many foreigners have secured land and houses in Thailand. However, they should beware and ensure of using trustworthy lawyers.

Yes, Thai spouses have right to own land. Before 1999, Thai spouses who married foreigners would lose their rights to own land after registered the marriages. Recently Ministerial regulation allows Thai spouses married to foreigners the right to purchase and own land, but the Thai spouses must prove that the money used in the purchase of freehold land is legally solely theirs with no foreign claim to it. This is usually achieved by the foreign spouses signing a declaration stating that the funds used for the purchase of property belonged to the Thai spouse prior to the marriage and are beyond his claim.

Yes, there are deeds in Thailand.

There are 2 main different kinds of deeds in Thailand which are land deeds and condominium unit ownership title deed.

Land Deeds

There are 4 types of land title deeds:

- Chanote or Nor Sor See (นส 4) in Thai, Title Deed in Engling, is the purest form of evidence that a person or individuals own a piece of land. Title deeds are given only for areas that are surveyed.

- Nor Sor Sam Gor (นส 3ก) is provided for the land that is awaiting the title deed. The land is measured by the Land. Department, it has its exact boundaries. Land with this type of deed may be sold, transferred, or mortgaged like the land with the title deeds (Chanote). To change Nor Sor Sam Gor (นส3ก) to a Chanote, the owners of the land have to file an application to the Land Department, requesting to change this type of deed to Chanote. The Land Department may grant an approval in the case there is no opposition made against the application.

- Nor Sor Sam (นส3) is as well, provided by the Land Department but never yet, been measured, the land has no exact boundaries. The Nor Sor Sam may later be switched to a Nor Sor Sam Gor(นส3ก) then transform to Chanote(title deed).

- Sor PorKor See Soon Nueng(สปก 401) is a type of deed that is surveyed, marked by numbered pegs in the ground. Land with Sor Por Kor See Soon Nueng can be developed and mortgaged in the same way as title deed land, but it has significant restriction. It’s title granted as a personal right to the original holder though they’re not allowed to sell or lease, it can only be transferred to the next of kin of the original holder.

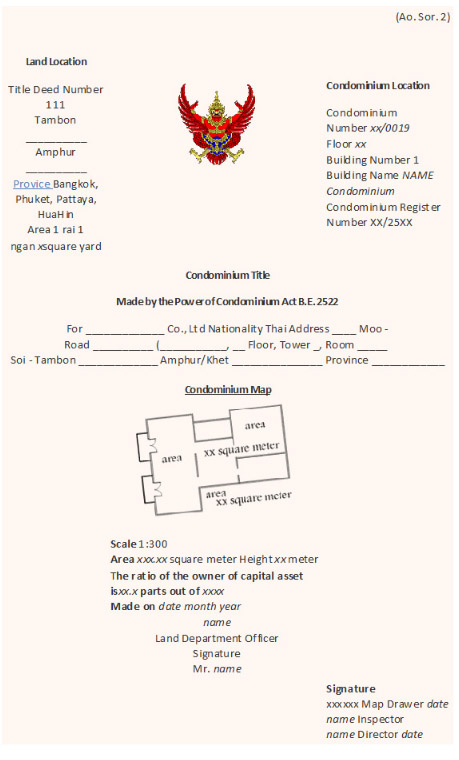

Condominium Unit Ownership Title Deed

The condominium unit ownership title deed is the ownership document issued by the Land Department. The deed contains the following main particulars:

1. Position and size of the land where the condominium buildings built on.

2. Location, size and plan of the condominium unit, and also its width, length and height.

3. Ratio of ownership of the total land.

4. Full name/s of the person/s having the ownership of the condominium unit.

5. Index for the registration of rights and juristic acts.

6. Signature of the Competent Official.

7. Position seal of the Competent Official.

Translation of Condominium Unit Ownership Title Deed

No, there are no property taxes in Thailand that are exactly equivalent to the property taxes in the west. For individual property owners if they rent/lease out their properties, there shall be Housing and Land tax collected at the rate of 12.5% of the yearly rental according to the lease agreement or the annual assessed value by the local authorities or whichever is higher.

YES, there are taxes and fees to be paid to the Land Department on property transfers in Thailand. There are no set rules on who pays these taxes and fees as it is another part of the negotiation process on property purchased.The following are types of taxes and fees which both parties should be partly responsible to the cost.

- Transfer fee. Transfer fee should be paid by the buyer by 2% of the registered value of the property.

- Stamp Duty. Stamp duty should be paid by the seller by 0.5% of registered value. Stamp duty is levied when business taxes are exempted.

- Income tax. Income tax should be paid by the seller, calculated between 1% and 3% of the appraised value or registered sale value of the property (whichever is higher and if the seller is a company). If the seller is an individual, income tax is calculated at a progressive rate based on the appraisal value of the property.

- Business tax. Business tax should be paid by the seller by 3.3% of the appraised value or registered sale value of the property (whichever is higher). This applies to both individuals and companies. Business tax levied against the property transfer registered to the possession of a property less than 5 years.

YES, there are taxes and fees to be paid to the Land Department on property transfers in Thailand. There are no set rules on who pays these taxes and fees as it is another part of the negotiation process on property purchased.The following are types of taxes and fees which both parties should be partly responsible to the cost.

- Transfer fee. Transfer fee should be paid by the buyer by 2% of the registered value of the property.

- Stamp Duty. Stamp duty should be paid by the seller by 0.5% of registered value. Stamp duty is levied when business taxes are exempted.

- Income tax. Income tax should be paid by the seller, calculated between 1% and 3% of the appraised value or registered sale value of the property (whichever is higher and if the seller is a company). If the seller is an individual, income tax is calculated at a progressive rate based on the appraisal value of the property.

- Business tax. Business tax should be paid by the seller by 3.3% of the appraised value or registered sale value of the property (whichever is higher). This applies to both individuals and companies. Business tax levied against the property transfer registered to the possession of a property less than 5 years.